Introduction

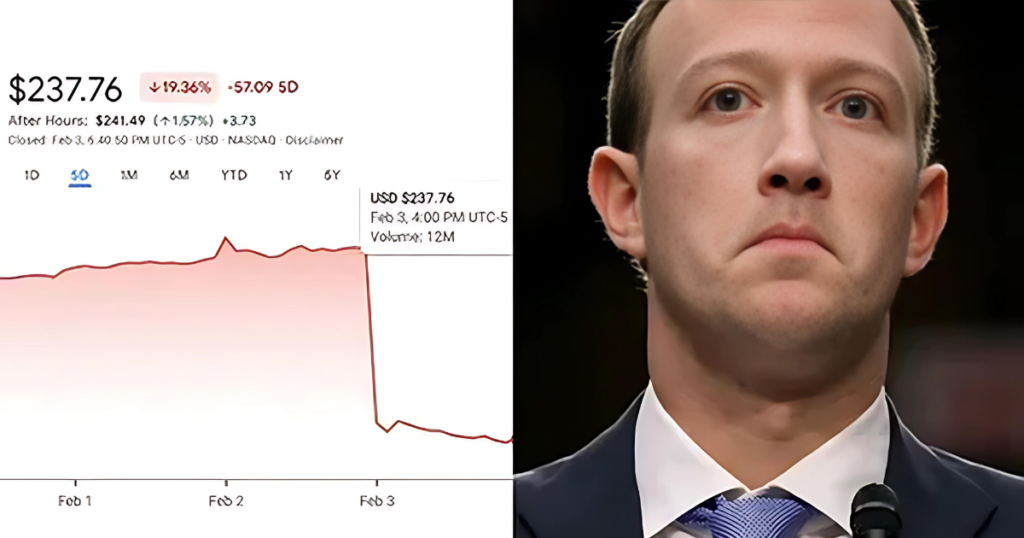

In a stunning reversal of fortunes, Meta stock took a beating in after-hours trading, plunging 16% despite the tech giant’s better-than-expected first-quarter results. The steep drop came as the company, formerly known as Facebook, issued a dismal revenue forecast for the current quarter, stoking concerns among investors about its long-term growth prospects.

Meta’s mixed earnings report sent shockwaves through Wall Street, with the meta stock price plummeting from over $200 per share to around $170 in a matter of hours. The selloff wiped out a staggering $60 billion from the company’s market capitalization, underscoring the heightened level of uncertainty and skepticism surrounding the social media behemoth.

“This is a massive overreaction by the market,” remarked veteran tech analyst Dan Ives of Wedbush Securities. “While the revenue guidance was certainly disappointing, Meta still delivered solid Q1 numbers and is actively navigating a challenging macro environment.”

Read More: DIGITAL NEWS PLANET

Q1 Results Surpass Expectations Amid Tough Climate

Amid a broader tech downturn and persistent economic headwinds, Meta managed to exceed Wall Street’s expectations for the first three months of 2023. The company reported revenue of $27.91 billion, edging out analysts’ consensus estimate of $27.67 billion.

Profit for the quarter came in at $5.71 billion, or $2.72 per share, surpassing the $2.56 per share forecast. This marked a significant improvement from the same period last year when Meta posted disappointing earnings that sent its stock into a tailspin.

“We had a solid quarter and continue making progress on our strategic priorities,” stated Meta CEO Mark Zuckerberg during the earnings call. “Our AI work is driving good results across our apps, and the groundbreaking generative AI research we’re leading will further unlock opportunities.”

Despite the Q1 beat, Zuckerberg’s reassurances did little to assuage investors’ mounting concerns about the company’s ability to sustain robust growth in the face of economic turbulence and rising competition.

Dismal Q2 Revenue Outlook Rattles Investors

While Meta’s first-quarter performance may have exceeded expectations, it was the company’s bleak revenue guidance for the current quarter that truly spooked Wall Street and triggered the vicious selloff.

For the second quarter of 2023, Meta expected RevenueRevenue to be between $27 billion and $29 billion, well below analysts’ consensus estimate of $30.63 billion. The company cited a multitude of factors contributing to the gloomy outlook, including macroeconomic pressures, increased competition, and persistent challenges in the digital advertising landscape.

“We’re navigating a tough environment with competition putting pressure on our operating model,” acknowledged CFO Susan Li during the earnings call. “Our guidance reflects the signals we’re seeing from the broader economy.”

The disappointing revenue projection not only raised alarm bells about Meta’s near-term prospects but also amplified broader concerns about the company’s long-term growth trajectory and its ability to maintain its dominance in the ever-evolving tech landscape.

Mounting Challenges and Existential Threats

Meta’s lackluster guidance and subsequent stock plunge have sharply focused the tech titan’s myriad challenges and existential threats. From fierce competition and regulatory scrutiny to shifting consumer behavior and the looming uncertainty surrounding its ambitious metaverse plans, the company finds itself at a critical juncture.

- The TikTok Effect: One of Meta’s most pressing concerns is the meteoric rise of TikTok. This short-form video platform has captivated younger audiences and disrupted the traditional social media landscape. As users, particularly Gen Z, flock to the viral video app, Meta’s core platforms, like Facebook and Instagram, are facing an uphill battle to retain their relevance and engagement levels.

- Privacy and Regulatory Headwinds: Meta has found itself in the crosshairs of regulators and privacy advocates, facing increasing scrutiny over data privacy practices, anticompetitive behavior, and content moderation policies. Looming regulatory changes, such as Apple’s App Tracking Transparency (ATT) framework, have already dealt a blow to Meta’s core advertising business, and the specter of further restrictions poses an ongoing threat.

- The Metaverse Gambit: Perhaps the most audacious and polarizing of Meta’s initiatives is its ambitious push into the metaverse, a futuristic concept of interconnected virtual worlds. While Zuckerberg remains bullish on the transformative potential of this technology, the metaverse endeavor has been a significant drain on resources, with the company’s Reality Labs division posting operating losses of billions of dollars. Skeptics question whether the metaverse will gain mainstream adoption and generate sustainable revenue streams.

- Economic Headwinds: Like many tech giants, Meta is not immune to the broader macroeconomic forces at play. Rising inflation, interest rate increases, and the potential for an impending recession have created a climate that is difficult for the company’s advertising-driven business model. As businesses tighten their marketing budgets, Meta’s revenue streams could face further pressure.

Wall Street’s Divided Outlook

In the wake of Meta’s earnings report and the subsequent stock plunge, Wall Street analysts are split on the company’s prospects and appropriate investment strategy.

The bears argue that the dismal guidance and mounting challenges facing Meta are indicative of deeper structural issues within the company. They contend that the social media giant’s best days are behind it and that the stock’s recent selloff is a harbinger of further declines to come.

“Meta is facing an existential crisis on multiple fronts,” warns Brian Wieser, global president of business intelligence at Moss Adams. “The competitive threats, regulatory pressures, and the metaverse distraction all point to a company that’s losing its grip on the digital advertising market it once dominated.”

On the bullish side, however, analysts like Ives of Wedbush Securities maintain that the selloff presents a compelling buying opportunity for long-term investors. They argue that Meta’s core business remains robust and that the company’s investments in AI, virtual reality, and the metaverse could pay off handsomely in the years to come.

“Investors with a longer-term horizon should see this as a unique chance to buy into a transformational tech leader at a discounted valuation,” Ives argues. “Meta is still printing cash, and its AI initiatives could be game-changers down the road.”

The Path Forward: Adapting or Reinventing?

As Meta grapples with the fallout from its disappointing guidance and the subsequent stock plunge, the company finds itself at a crossroads. It must now decide whether to double down on its core business model and platforms or embrace a more radical reinvention in pursuit of long-term growth and relevance.

One path forward :

- A renewed focus is on bolstering Meta’s existing social media platforms.

- Enhancing their appeal to younger demographics.

- Shoring up the company’s digital advertising prowess.

This strategy would entail significant investments in product development, content moderation, and user experience enhancements to fend off encroaching competitors like TikTok.

Alternatively, Meta could pursue its ambitious metaverse plans further, betting heavily on immersive virtual worlds’ potential to reshape the tech landscape. This approach would require a sustained commitment of resources, talent, and capital despite the metaverse’s uncertain path to profitability and mainstream adoption.

A third option could involve a strategic pivot towards other high-growth areas within the tech sector, such as artificial intelligence, cloud computing, or even fintech. Meta could lessen its reliance on the erratic digital advertising market and set itself up for long-term success by diversifying its sources of income and utilizing cutting-edge technology.

Regardless of the path it chooses, one thing is clear: Meta can no longer afford to rest on its laurels or rely solely on the strength of its established platforms. The company must adapt and innovate at an unprecedented pace to navigate the rapidly shifting technological landscape and address the existential threats looming on the horizon.

The AI Imperative

One area where Meta is doubling down its efforts is artificial intelligence (AI), a technology that may change almost every facet of the business’s services and operations.

During the earnings call, Zuckerberg emphasized Meta’s commitment to AI, highlighting the company’s groundbreaking research in generative AI and the integration of AI models across its suite of apps and services.

“AI is going to be a key driver for our products and the entire tech industry going forward,” Zuckerberg stated. “We’re leading the way with research breakthroughs and embedding AI capabilities across our apps to deliver better experiences for people.”

Indeed, Meta has been at the forefront of AI research and development, with its AI lab producing cutting-edge models like the Generative AI for Reinforced Task Completion (GAtOR) and the Socratic Model for Conversing Mind (SoCraMic). These advanced language models have the potential to revolutionize everything from content moderation and recommendation systems to virtual assistants and immersive experiences within the metaverse.

However, Meta’s AI ambitions extend far beyond its products and services. The company has also made significant investments in open-source AI initiatives, releasing models and datasets to the broader research community in an effort to accelerate the development of safe and responsible AI systems.

“Meta understands that the AI revolution is bigger than any single company,” explains Yoshua Bengio, a well-known AI expert and University of Montreal professor. “By contributing to open-source efforts, they’re positioning themselves as a key player in shaping the future of this transformative technology.”

While the integration of AI capabilities could unlock new revenue streams and enhance Meta’s existing offerings, the company’s AI push is not without its critics and skeptics.

Advanced AI systems have sparked concerns about their possible hazards and ethical ramifications, especially in relation to privacy, algorithmic prejudice, and content control. There are also questions about the long-term commercial viability of Meta’s AI initiatives, as the business competes fiercely to create and market AI solutions against industry titans like Microsoft, Google, and OpenAI.

Navigating Regulatory Headwinds

Another significant challenge facing Meta is the increasingly stringent regulatory environment in which it operates. From data privacy and antitrust concerns to content moderation policies, the company finds itself under intense scrutiny from governments and watchdog groups around the world.

In the United States, Meta is currently embroiled in a high-stakes antitrust lawsuit brought by the Federal Trade Commission (FTC). The lawsuit alleges that Meta has engaged in anticompetitive practices to maintain its dominance in the social media market. The outcome of this legal battle could have far-reaching implications for Meta’s business model and future acquisitions.

Meanwhile, in Europe, the company is grappling with the implementation of the Digital Services Act (DSA) and the Digital Markets Act (DMA), two sweeping pieces of legislation aimed at reining in the power of big tech companies and promoting fair competition in the digital realm.

“These new regulations are going to force Meta to rethink how it operates and interacts with users fundamentally,” says Ashkan Soltani, an independent privacy researcher and former chief technologist at the FTC. “The days of unfettered data collection and unchecked market dominance are numbered.”

To navigate these regulatory challenges, Meta has been actively engaging with policymakers and stakeholders, advocating for a balanced approach that fosters innovation while protecting consumer rights and promoting fair competition.

The company has also been investing heavily in compliance efforts, bolstering its legal teams, and implementing new policies and procedures to align with emerging regulations. However, these measures come at a significant cost, both financially and in terms of potential constraints on Meta’s business practices and growth strategies.

The Metaverse Gambit

Perhaps no initiative exemplifies Meta’s boldness and willingness to disrupt itself quite like its audacious push into the metaverse – the much-hyped concept of interconnected virtual worlds that blend physical and digital realities.

Since rebranding from Facebook to Meta in 2021, the company has poured billions of dollars into its Reality Labs division, the epicenter of its metaverse ambitions. This investment has yielded cutting-edge hardware like the Quest virtual reality (VR) headsets and ongoing development of immersive metaverse experiences and applications.

“The metaverse is the future of computing, and we’re leading the way in building it,” Zuckerberg proclaimed during the earnings call. “This is a massive opportunity for us to create entirely new experiences and unlock new revenue streams beyond our core business.”

While the potential of the metaverse is undoubtedly compelling, with promises of revolutionizing everything from gaming and entertainment to e-commerce and remote work, the path to realizing this vision is fraught with challenges and uncertainties.

Skeptics question whether consumers and businesses will genuinely embrace the metaverse concept, citing concerns about privacy, cybersecurity, and the practical limitations of current VR technology. They also doubt the metaverse’s ability to generate sustainable revenue streams and justify the billions of dollars Meta has already invested in the endeavor.

“The metaverse is still largely a conceptual idea, and we’re years away from seeing widespread adoption,” cautions Andrien Greene, an analyst at Forrester Research. “Meta is essentially betting the farm on an unproven market, which is a perilous proposition for a company of its size and stature.”

Despite the risks and uncertainties, Meta remains undeterred in its metaverse pursuit, viewing it as a long-term strategic imperative and a potential game-changer for the company’s future growth and relevance.

The Content Moderation Conundrum

One of the thornier issues facing Meta is the ongoing challenge of content moderation, which has become increasingly complex and contentious in the age of misinformation, hate speech, and polarized political discourse.

With billions of users generating vast amounts of content across its various platforms, Meta has been forced to rely heavily on a combination of human moderators and artificial intelligence systems to filter out harmful or objectionable material. However, this approach has drawn criticism from all sides, with accusations of censorship, algorithmic bias, and inadequate safeguards.

“In terms of content moderation, Meta finds itself in a difficult situation,” says Dipayan Ghosh, a former privacy and public policy advisor at Facebook. “They face intense pressure from governments and advocacy groups to crack down on misinformation and hate speech, but any perceived overreach or bias in their moderation practices ignites backlash from users and free speech advocates.”

The company’s content moderation woes were thrust into the spotlight in 2021 when former employee Frances Haugen leaked internal documents revealing systemic flaws in Meta’s approach. These included allegations that the company prioritized profits over the safety of its users and disregarded the spread of hate speech and misleading material on its platforms.

In the aftermath of the whistleblower scandal, Meta has pledged to invest more resources into content moderation and to increase transparency around its policies and enforcement practices. However, critics remain skeptical, arguing that the company’s business model and algorithms are inherently geared towards amplifying divisive and sensationalized content.

“At the end of the day, Meta’s algorithms are designed to maximize engagement and advertising revenue,” argues Ghosh. “Until they fundamentally rework their incentive structures, content moderation will remain an uphill battle and a perpetual source of controversy.”

Diversifying Revenue Streams

As Meta confronts the myriad challenges threatening its core advertising-driven business model, diversifying its revenue streams beyond digital advertising could potentially provide one avenue for sustained growth and resilience.

While the company has dabbled in e-commerce initiatives like Facebook Marketplace and Instagram Shopping, these efforts have yet to yield significant revenue contributions. However, industry analysts believe that Meta could leverage its vast user base and troves of consumer data to disrupt other sectors, such as fintech, healthcare, and even enterprise software solutions.

“Meta has an incredible opportunity to capitalize on its massive user base and data assets by venturing into new verticals like fintech or healthcare,” says Dan Ives of Wedbush Securities. “These are multi-trillion-dollar markets ripe for disruption, and Meta has the resources and innovative spirit to make a major play.”

One potential avenue could be the development of a comprehensive digital wallet and payment solution, leveraging the ubiquity of WhatsApp and Facebook Messenger to facilitate peer-to-peer transactions, e-commerce payments, and even financial services like lending or investment products.

“If Meta can crack the code on digital payments and fintech, it could unlock an entirely new revenue stream that’s less susceptible to the volatility of the advertising market,” Ives adds.

Similarly, Meta’s vast trove of user data and AI capabilities could position the company as a disruptive force in the healthcare sector, enabling personalized health insights, telemedicine services, and even drug discovery or clinical trial recruitment through data-driven approaches.

However, any forays into new verticals would likely face significant regulatory scrutiny and privacy concerns, given Meta’s checkered history with data practices and the sensitivity of financial and health-related information.

“If Meta is to be successful in sectors like fintech or healthcare, it will have to regain confidence and show that it is committed to data protection and moral behavior, ” cautions Ashkan Soltani, the independent privacy researcher.

Nonetheless, as the company grapples with the challenges facing its core advertising business, diversifying its revenue streams could prove to be a crucial lifeline, opening up new avenues for growth and insulating it from the ebbs and flows of the digital advertising market.

The Road Ahead

As Meta navigates the turbulent waters of technological disruption, regulatory headwinds, and shifting consumer behavior, one thing becomes increasingly clear: the company can no longer rely on its past successes or the dominance of its established platforms.

A careful balancing act will be necessary to navigate the future – doubling down on core strengths while simultaneously embracing bold reinvention and diversification. Whether through a renewed focus on its advertising prowess, a full-throated pursuit of the metaverse, or a strategic pivot into new revenue verticals, Meta must chart a course that ensures its long-term relevance and profitability.

Perhaps most crucially, the company must address the existential threats posed by fierce competition, regulatory scrutiny, and the erosion of public trust. Rebuilding credibility and fostering a culture of transparency, ethical behavior, and user-centric innovation will be paramount to weathering the storms ahead.

As investors, industry watchers, and consumers alike scrutinize Meta’s every move, one thing is sure: the road ahead will be a consequential and transformative journey, one that could redefine the boundaries of what’s possible in the digital realm and shape the future of technology for generations to come.

Conclusion

The recent plunge in Meta’s stock price, fueled by disappointing revenue guidance and mounting concerns about the company’s long-term prospects, has sent shockwaves throughout the tech industry and investor community. What was once a seemingly unstoppable juggernaut now finds itself at a crossroads, grappling with existential threats from fierce competition, regulatory headwinds, and the looming uncertainty surrounding its ambitious metaverse ambitions.

However, amid the turmoil and uncertainty, one thing remains clear: Meta possesses the resources, talent, and innovative spirit to navigate these challenges and chart a path toward sustained growth and success. Whether through a renewed focus on its core business, a doubling down on emerging technologies like AI, or a bold reinvention centered around the metaverse, the company has multiple avenues to explore.

In the end, Meta’s capacity for innovation, adaptation, and maintaining its innovation will be essential to its long-term survival and prosperity. The tech giant must embrace an agile and forward-thinking mindset, shedding any complacency or reliance on past successes, and boldly confront the disruptions and paradigm shifts that define the ever-evolving tech landscape.

-

Why did Meta’s stock price plunge 16% after the Q1 earnings report?

Despite beating Wall Street’s estimates for Q1 revenue and profit, Meta issued weak revenue guidance for Q2 2023, citing macroeconomic pressures and increased competition. This dismal outlook spooked investors and triggered a massive selloff in the stock.

-

What are some of the significant challenges facing Meta?

Critical challenges for Meta include fierce competition from rivals like TikTok, regulatory scrutiny over data privacy and antitrust issues, the uncertain path to profitability for its metaverse investments, and broader economic headwinds impacting the digital advertising market.

-

How is Meta addressing the competitive threat from TikTok?

Meta is exploring various strategies to counter TikTok’s rise, including enhancing its existing platforms like Instagram and Facebook with new features and algorithms tailored to younger audiences. The company is also investing heavily in AI and metaverse technologies to stay ahead of the curve.

-

What is Meta’s approach to navigating the regulatory landscape?

Meta has been actively engaging with policymakers, advocating for balanced regulations that foster innovation while protecting consumer rights. The company is also bolstering its legal teams and implementing new policies to align with emerging regulations like the Digital Services Act and Digital Markets Act in Europe.

-

What is the metaverse, and why is it so crucial to Meta’s future?

The metaverse is a concept of interconnected virtual worlds that blend physical and digital realities. Meta sees the metaverse as the next central computing platform and has invested billions into developing hardware, software, and experiences for this space. The metaverse is viewed as a potential game-changer for Meta’s long-term growth and relevance.