Student Debt Relief, on Wednesday, the federal Education Department zeroed out loan balances for nearly 153,000 borrowers. They are people who borrowed $12,000 or less, have been paying their student loans for at least 10 years, and enrolled in the Biden administration’s new repayment plan called SAVE launched last summer.

Keep Updated on: Digital News Planet

“We’re providing debt relief to people who need it the most,” said Education Secretary Miguel Cardona on Wednesday in an interview on NPR’s Morning Edition. “We’re also addressing the root cause of the issue, which is, the cost of college is out of control,” Cardona said.

Biden-Harris Administration: Student Debt Relief

The Biden-Harris Administration has now approved nearly $138 billion in Student Debt Relief for almost 3.9 million borrowers through more than two dozen executive actions.

The borrowers receiving relief are the first to benefit from a SAVE plan policy that provides debt forgiveness to borrowers who have been in repayment after as little as 10 years and took out $12,000 or less in student loans.

Originally planned for July, the Biden-Harris Administration implemented this provision of SAVE and is providing relief to borrowers nearly six months ahead of schedule.

While Republicans in Congress and their allies try to block President Biden every step of the way, the Biden-Harris Administration continues to Student Debt Relief for millions of borrowers, and is leaving no stone unturned in the fight to give more borrowers breathing room on their student loans.

For example, a borrower enrolled in SAVE who took out $14,000 or less in federal loans to earn an associate’s degree in biotechnology would receive full debt relief starting this week if they have been in repayment for 12 years.

The U.S. Department of Education (Department) identified nearly 153,000 borrowers who are enrolled in SAVE plan who will have their debt cancelled starting this week, and those borrowers will receive an email today from President Biden informing them of their imminent relief.

The White House encourages borrowers who believe they may be eligible for relief under the SAVE Plan to sign up on the federal student aid website.

These borrowers will start getting emails from the Biden administration as early as Wednesday informing them that they will receive debt forgiveness. They don’t need to take any further action to get their relief. As loan servicers process their forgiveness, they will see their debts discharged from their accounts.

Borrowers who qualify for the shortened time to forgiveness but who have not signed up for SAVE will be contacted by the Department of Education in the coming weeks about enrolling. At present, 7.5 million borrowers are registered for SAVE, and 4.3 million of them have monthly payments of $0 based on their incomes.

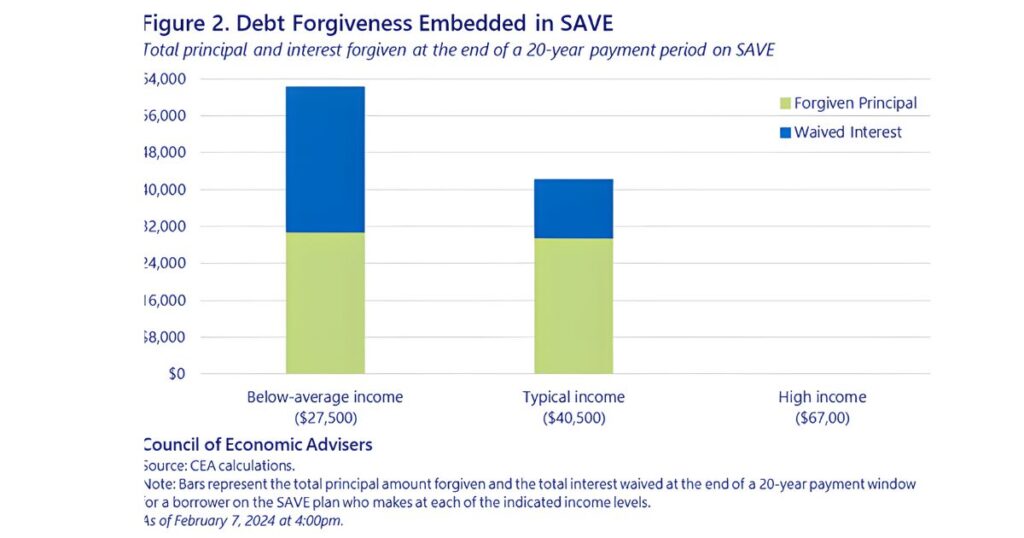

The Biden-Harris administration describes the SAVE Plan as “the most-affordable repayment plan for low-and middle-income borrowers,” noting that it allows many of these individuals to obtain earlier loan forgiveness. All SAVE enrollees will earn forgiveness after 20 or 25 years, as the time frame varies based on whether borrowers have graduate school loans.

Although the Supreme Court blocked the administration’s loan forgiveness plan in June that would have canceled up to $20,000 in debt for all borrowers earning under $125,000 annually, the administration has, to date, approved debt relief for 3.9 million people amounting to roughly $138 billion.

Meanwhile, the department is hammering out the details of a second swing at a broader student loan forgiveness program that would relieve debt for borrowers in financial hardship, among others. Those rules are expected to be finalized later this year.

Under SAVE, borrowers with federal student loans make payments equaling 10% of their discretionary income, an amount that’s set to be cut in half this summer. After paying for 20 years (or 10 in the case of loans under $12,000) anything left over is forgiven.